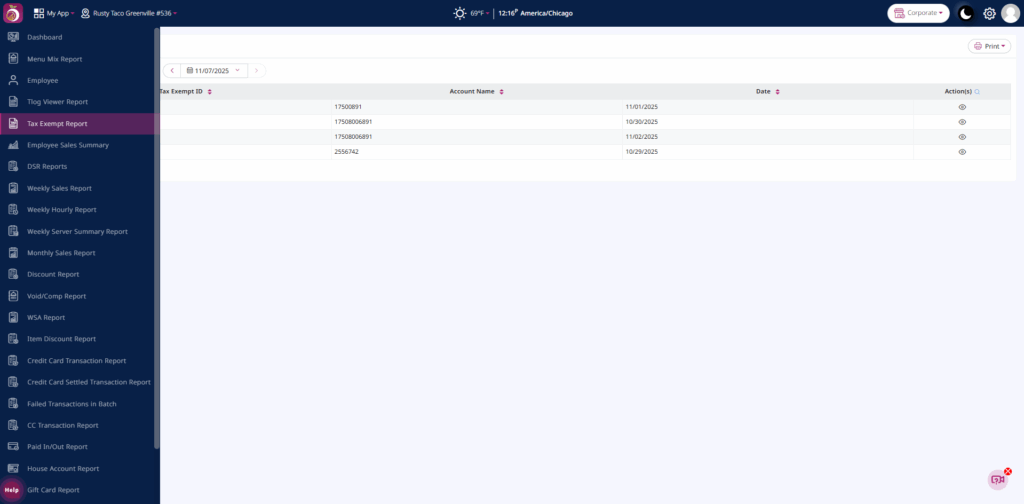

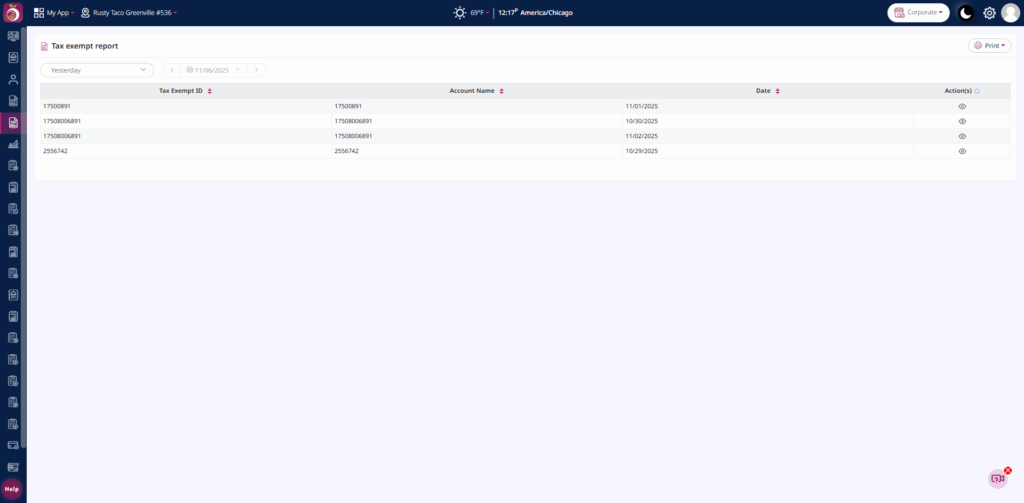

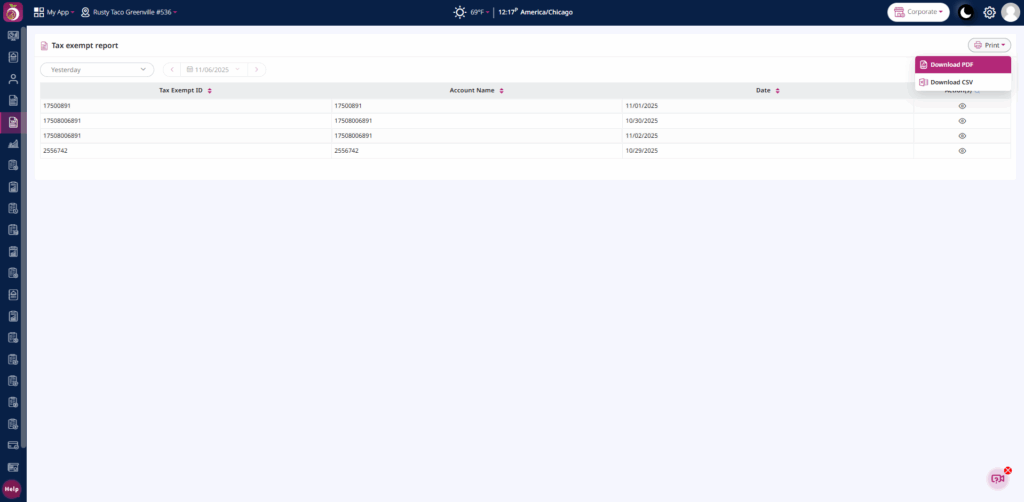

The Tax Exempt Report lists all restaurant orders that are exempted from tax in the POS system. It provides a clear record of transactions processed without tax during a selected period. This ensures proper tax management and maintains transparency in financial data.

Key Details Included in the Report

- Tax Exempt ID: A unique identifier assigned to each tax-exempt transaction for easy tracking.

- Account Name: The name of the customer, organization, or account that is eligible for tax exemption.

- Date: The date when the tax-exempt transaction was processed.

Action(s): Details of the transaction or actions performed, such as Applied, Removed, or Updated.

Step 1: Navigate to the Tax Exempt Report section from the main menu.

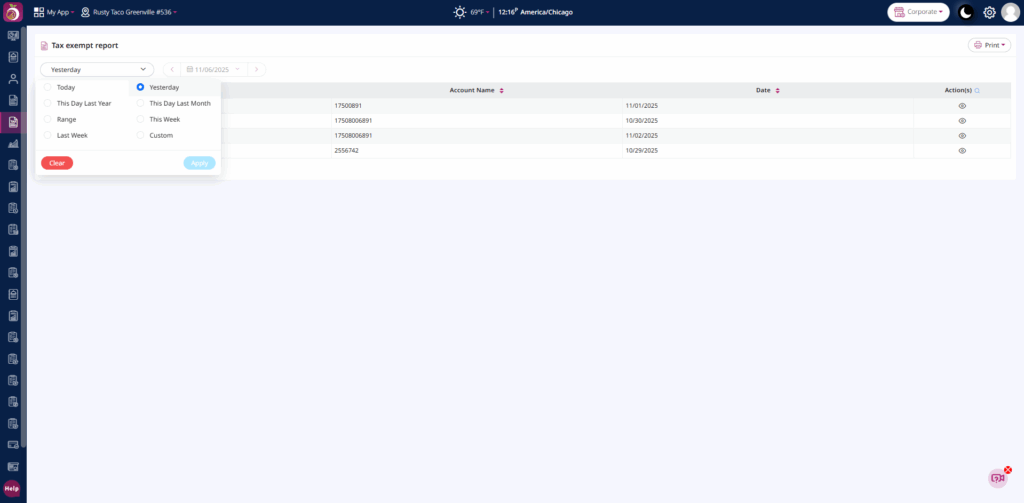

Step 2: Select the Date Range: Choose the start and end dates for the transactions you want to view.

Step 3: Generate the Report: Click the ‘Print’ [button] to generate or download the report.

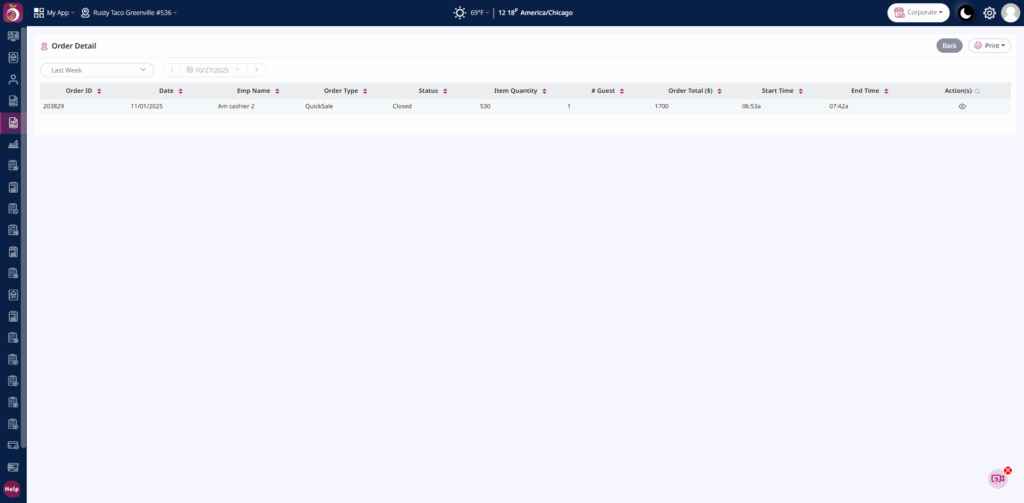

Detail screen of the Tax Exempt Report